In the rapidly evolving electric vehicle landscape of India, Ola Electric has emerged as a pivotal player, capturing investor attention with its ambitious growth plans and innovative approach. As the EV revolution accelerates, understanding the trajectory of Ola Electric shares becomes crucial for both current shareholders and potential investors looking to capitalize on India’s green mobility transition.

Company Background and Evolution

Ola Electric Mobility Limited began its journey as a subsidiary of ANI Technologies (better known as Ola Cabs) before establishing itself as an independent entity in 2018. Founded by Bhavish Aggarwal, the company strategically pivoted from ride-hailing services to focus exclusively on electric vehicles, recognizing the immense potential of the EV market in India.

The company has rapidly positioned itself as one of the frontrunners in India’s electric vehicle segment, with a particular focus on electric two-wheelers. Ola Electric operates India’s largest electric two-wheeler manufacturing facility, the Ola Futurefactory, located in Tamil Nadu. This state-of-the-art facility is designed to be the most advanced and automated manufacturing plant in the country, giving Ola Electric shares a solid foundation of manufacturing excellence.

Ola Electric’s business model centers around developing and manufacturing EVs and core components, including battery packs, motors, and vehicle frames. The company’s flagship product line, the Ola S1 series, includes various models like the S1 Pro, S1 Air, and S1 X+, catering to different customer segments across personal and commercial mobility.

With a direct-to-customer distribution approach, Ola Electric has established an extensive network of experience centers and service hubs across India, creating the largest customer touchpoint infrastructure in the Indian EV space. This expansive network provides crucial support for the long-term value of Ola Electric shares.

Ola Electric IPO Journey

Ola Electric made its entry into the public markets with an Initial Public Offering (IPO) that opened on August 2, 2024, and closed on August 6, 2024. The IPO was priced in the range of ₹72 to ₹76 per share, with a lot size of 195 shares, requiring a minimum investment of ₹14,820.

The IPO consisted of a fresh issue worth ₹5,500 crores and an offer for sale component of approximately ₹645.56 crores, bringing the total issue size to ₹6,145.56 crores. The funds raised through the fresh issue were earmarked for several strategic initiatives:

- Capital expenditure for expanding Ola Cell Technologies (₹1,227.64 crores)

- Debt reduction of Ola Electric Technologies (₹800 crores)

- Research and development investment (₹1,600 crores)

- Organic growth-related expenses (₹350 crores)

- General corporate purposes (₹1,375 crores)

The subscription pattern during the IPO reflected varying levels of interest across investor categories. On the first day, the retail portion was subscribed 1.70 times, while the employee portion saw an impressive 5.42 times subscription. By the second day, subscription levels increased across all categories, with the employee portion reaching 9.71 times, retail at 3.04 times, and non-institutional investors at 1.17 times.

Ola Electric shares were listed on August 9, 2024, marking the company’s formal entry into the public markets. The post-IPO performance has been characterized by significant volatility, reflecting both market sentiment toward EV stocks and company-specific developments that have influenced Ola Electric shares.

Current Financial Performance

Understanding the current financial health of Ola Electric is essential for evaluating its shares as an investment option. The company reported its Q3 FY25 results on February 7, 2025, providing insights into its operational and financial performance that directly impact Ola Electric shares.

In Q3 FY25, Ola Electric reported:

- Revenue from operations: ₹1,045 crores, a decline of 19.36% year-on-year from ₹1,296 crores in Q3 FY24

- Net loss: ₹564 crores, wider than the ₹376 crores loss in the year-ago quarter

- Deliveries: 84,029 units

- Gross margin: 20.4%

- Auto EBITDA margin: -28.8%

- Consolidated EBITDA margin: -40.7%

The company attributed the quarterly performance to high competitive intensity and service challenges. October 2024 saw strong performance fueled by festival sales, but the overall quarter remained weak. However, the company claimed to have fixed service issues and expanded its network, resulting in market share gains and margin improvements by January 2025.

Despite the revenue decline, Ola Electric’s automotive gross margin improved by 20 basis points quarter-on-quarter to 20.8% in Q3 FY25. This resilience was driven by a 1 percentage point quarter-on-quarter reduction in bill of materials (BOM) costs and the benefit of Production Linked Incentive (PLI) accruals across its product range, contributing a 5 percentage point margin uplift.

For the full fiscal year 2024, Ola Electric reported:

- Total revenue: ₹5,243.27 crores, an 88.42% growth from ₹2,782.70 crores in FY 2023

- Net loss: ₹1,584.40 crores, compared to ₹1,472.08 crores in FY 2023

- Operating profit margin: -27.78%, an improvement from -48.18% in FY 2023

- Net profit margin: -31.62%, better than -55.95% in FY 2023

These figures indicate that while Ola Electric is experiencing strong year-on-year revenue growth, profitability remains a challenge, which is common for rapidly expanding companies in the EV space. This financial performance has been a key factor in the recent performance of Ola Electric shares.

Ola Electric Share Price Analysis

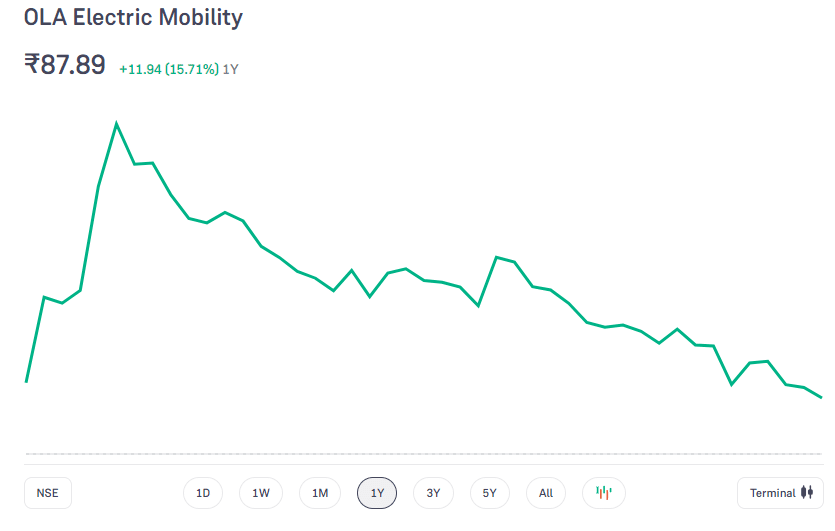

As of March 13, 2025, Ola Electric shares were trading at ₹50.51, representing a decline of 1.08% from the previous day’s close of ₹51.06. The stock has experienced significant downward momentum in recent months, with returns of:

- 1 Week: -10.65%

- 1 Month: -17.02%

- 3 Months: -46.16%

Ola Electric shares have reached their 52-week low recently, having declined substantially from the 52-week high of ₹158.00. This significant drop from the IPO price of ₹76 reflects both market-wide sentiment towards growth stocks and company-specific challenges affecting Ola Electric shares.

Key valuation metrics for Ola Electric shares include:

- Market capitalization: Approximately ₹21,498 crores

- Book value: ₹14.9 per share

- Price-to-book ratio: 3.39 times

The technical indicators suggest a bearish trend in the short term, with Ola Electric shares trading below most of their moving averages. However, some analysts view the current price levels as a potential entry point for long-term investors who believe in the company’s growth story and the broader EV adoption trend in India.

Technical Analysis of Ola Electric Shares

Beyond fundamental analysis, technical indicators provide additional insights for investors considering entry or exit points for Ola Electric shares.

The price action of Ola Electric shares since its IPO has formed a distinct pattern. After listing at a premium to its IPO price of ₹76, the stock initially saw positive momentum, reaching its 52-week high of ₹158. However, this was followed by a sustained downtrend, bringing the price to around ₹50 levels currently.

This decline has created a descending channel pattern on the charts, with successive lower highs and lower lows. For technical analysts, a breakout above this channel would be a significant bullish signal for Ola Electric shares, potentially indicating a trend reversal.

Trading volumes in Ola Electric shares have been telling. Periods of price decline have generally been accompanied by increasing volumes, suggesting strong selling pressure. For a sustainable recovery, investors should look for price increases supported by above-average volumes, which would indicate genuine buying interest in Ola Electric shares rather than a temporary bounce.

Current key support levels for Ola Electric shares appear around ₹48-50, which coincide with recent lows. If this support is breached, the next significant support level could be around ₹40-42.

On the upside, immediate resistance is visible at ₹55-56, followed by a stronger resistance zone at ₹65-68. Breaking above ₹70 would be a significant psychological barrier for Ola Electric shares, representing a return to near-IPO price levels.

Factors Influencing Ola Electric Shares

Several key factors continue to influence the performance of Ola Electric shares:

1. EV Market Growth in India

The electric two-wheeler market in India is experiencing rapid growth. Q3 FY25 recorded the highest-ever e2W registrations at 333,000 units, up 15.9% quarter-on-quarter and 37.5% year-on-year. This trend indicates growing consumer preference for EVs and creates a favorable macro environment for Ola Electric’s business expansion, potentially supporting Ola Electric shares in the long term.

2. Government Policies and Incentives

Government initiatives like the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) batteries and electric vehicles have provided significant support to Ola Electric. The company was selected as the only Indian EV company under the cell PLI scheme, receiving a maximum capacity allocation of 20 GWh, which positions it advantageously in the industry and could positively impact Ola Electric shares.

3. Competition in the EV Space

Ola Electric faces intensifying competition from both traditional two-wheeler manufacturers entering the EV space and pure-play EV startups. The company competes with established players like Hero MotoCorp, Bajaj Auto, and fellow EV specialists like Ather Energy. This competitive pressure has led to pricing pressures and higher marketing expenses, impacting profitability and creating headwinds for Ola Electric shares.

4. Manufacturing Capabilities and Scale

Ola Electric’s Futurefactory, which is the largest integrated and automated electric two-wheeler manufacturing plant in India, provides a significant competitive advantage that could eventually reflect in the value of Ola Electric shares. The company’s vertical integration strategy, including in-house production of battery packs and motors, allows for better control over costs and quality.

5. Innovation and R&D

Continuous investment in research and development across facilities in India, the UK, and the US enables Ola Electric to innovate and improve its products. The company allocated ₹1,600 crores from its IPO proceeds specifically for R&D, highlighting its commitment to technological advancement, which could drive long-term value for Ola Electric shares.

Ola Electric Share Price Targets (2025-2030)

Based on current metrics, market trends, and expert forecasts, projected share price targets for Ola Electric from 2025 to 2030 present an optimistic long-term outlook despite short-term volatility.

Short-term Projections (2025-2026)

For 2025, Ola Electric shares are projected to range between ₹100 and ₹120, representing significant potential upside from current levels. This projection is based on expected improvements in production capacity, service infrastructure, and the initial benefits from the company’s vertical integration initiatives.

Moving into 2026, analysts expect Ola Electric shares to trade in the range of ₹130 to ₹160, driven by continued market share gains, improved operational efficiency, and potential progress toward profitability.

Medium-term Outlook (2027-2028)

The medium-term outlook for Ola Electric shares appears more robust, with projections of ₹170 to ₹210 for 2027 and ₹220 to ₹270 for 2028. This expected appreciation reflects:

- Anticipated benefits from the full-scale operation of Ola’s cell manufacturing facility

- Market expansion through a diversified product portfolio including motorcycles

- Improved margins through vertical integration and economies of scale

- Potential entry into international markets

Long-term Forecast (2029-2030)

Looking further ahead, Ola Electric shares are projected to reach ₹280 to ₹340 by 2029 and potentially ₹350 to ₹420 by 2030. These long-term projections for Ola Electric shares are predicated on:

- Ola Electric establishing itself as a dominant player in the Indian EV ecosystem

- The company achieving sustainable profitability

- Successful expansion beyond two-wheelers into other vehicle segments

- Significant contribution from international markets

- Maturity of the overall EV market in India with higher adoption rates

It’s important to note that these projections for Ola Electric shares are subject to various factors, including the pace of EV adoption in India, competitive dynamics, regulatory changes, and the company’s execution of its strategic initiatives.

Strengths and Challenges for Ola Electric

Strengths

- Market Leadership: Despite increased competitive intensity, Ola Electric maintained the #1 market share at 25.5% in the electric two-wheeler segment, demonstrating its strong brand position and supporting the long-term case for Ola Electric shares.

- Vertical Integration: The company’s strategy to produce key components in-house, including battery cells, provides a significant competitive advantage in terms of cost control and quality management, which could enhance the value of Ola Electric shares over time.

- Distribution Network: Ola Electric has expanded to over 4,000 touchpoints, creating India’s largest EV distribution network, which enhances customer access and service delivery, potentially improving the performance of Ola Electric shares.

- Product Innovation: The introduction of new models, including the Gen 3 platform offering 20% higher peak power, 11% lower cost, and 20% increased range, showcases the company’s innovation capabilities that could drive future growth in Ola Electric shares.

- Government Support: Selection under the ACC PLI scheme with a 20 GWh capacity allocation provides financial incentives and validates the company’s technological capabilities, offering potential catalysts for Ola Electric shares.

Challenges

- Profitability Concerns: Ola Electric continues to report significant losses, with a net loss of ₹564 crores in Q3 FY25, raising questions about the timeline to profitability and creating doubts about Ola Electric shares.

- Service Issues: Historical challenges with after-sales service have impacted customer satisfaction and brand perception, though the company claims to have addressed these issues. These concerns have weighed on Ola Electric shares.

- Competitive Pressure: Increasing competition in the e2W space has led to pricing pressures and higher marketing expenses, affecting margins and potentially limiting upside for Ola Electric shares.

- Execution Risks: The ambitious plans for vertical integration, particularly in cell manufacturing, carry execution risks that could impact projected timelines and benefits, creating uncertainty for Ola Electric shares.

- Financial Health: With a high cash burn rate, the company needs to carefully manage its capital resources to achieve its long-term objectives without requiring frequent additional fundraising, which could dilute existing shareholders of Ola Electric shares.

Strategic Initiatives and Future Plans

Ola Electric has outlined several strategic initiatives to drive growth and enhance shareholder value through appreciation of Ola Electric shares:

1. Product Expansion

The company has expanded beyond its initial S1 Pro electric scooter to a comprehensive portfolio including:

- S1 Pro+ with a larger 5.3 kWh battery

- Ola Gig and Gig+ models targeting commercial use cases

- S1 Z addressing more price-sensitive segments

- Roadster series of electric motorcycles entering India’s largest two-wheeler market segment

This product diversification strategy allows Ola Electric to address various customer segments and use cases, potentially expanding its addressable market and supporting growth in Ola Electric shares.

2. Cell Manufacturing

A cornerstone of Ola Electric’s strategy is its venture into lithium-ion cell manufacturing. The company is setting up India’s first lithium-ion cell manufacturing facility in Krishnagiri, Tamil Nadu, with an initial capacity of 5 GWh in phase I, scalable to 100 GWh in later phases.

The 4680 Bharat Cell is scheduled to start powering Ola’s products from Q1 FY26, which is expected to reduce battery costs significantly and boost margins. This vertical integration positions Ola Electric advantageously in the supply chain for critical EV components, potentially driving substantial value for Ola Electric shares.

3. Cost Optimization

Ola Electric has initiated various cost reduction measures, achieving a 1 percentage point reduction in bill of materials (BOM) costs quarter-on-quarter. The Gen 3 platform is expected to deliver further cost savings, improving the company’s competitive position and potentially accelerating the path to profitability, which would be a significant positive for Ola Electric shares.

4. Service Network Enhancement

Recognizing service quality as a critical success factor, Ola Electric has invested heavily in expanding and improving its service infrastructure. The reduction in service turnaround time to 1.1 days represents a significant improvement and addresses a key customer concern, potentially improving brand perception and supporting Ola Electric shares.

Financial Health Deep Dive

A more detailed examination of Ola Electric’s financial position reveals both strengths and areas of concern for investors in Ola Electric shares.

Capital Structure and Debt

As of the latest available financial data, Ola Electric has taken on debt obligations for the first time in the last five years. This represents a shift in the company’s capital structure approach, potentially indicating a more balanced funding strategy or response to current market conditions for equity financing.

The company allocated ₹800 crores from its IPO proceeds specifically for debt reduction at Ola Electric Technologies, suggesting a strategic approach to optimizing its capital structure, which could improve the risk profile for Ola Electric shares.

Cash Flow Analysis

Ola Electric’s cash flow pattern reflects its growth-focused strategy. The company has used ₹1,136.28 crores for investing activities, a year-on-year increase of 256.7%. This substantial investment activity underscores the capital-intensive nature of building manufacturing capabilities and vertical integration in the EV industry.

Operating cash flows remain negative, consistent with the company’s current profitability profile. Improving the conversion of EBITDA to operating cash flow will be a key metric to watch as the company scales, and could significantly impact the valuation of Ola Electric shares.

Working Capital Management

The expansion of production capacity and distribution network places significant demands on working capital. Effectively managing inventory levels, supplier payment terms, and customer advances will be crucial for optimizing capital efficiency.

As Ola Electric scales its operations, particularly with the introduction of new models and entry into cell manufacturing, working capital requirements are likely to increase. The company’s ability to secure favorable terms from suppliers and efficiently manage its working capital cycle will impact its funding needs and overall financial health, with direct implications for Ola Electric shares.

Investment Perspective: Evaluating Ola Electric Shares

For investors considering Ola Electric shares, several factors merit consideration:

Growth Potential

The Indian electric two-wheeler market is projected to grow exponentially over the next decade, driven by increasing environmental consciousness, government incentives, and the economic benefits of electric vehicles. As a market leader, Ola Electric is well-positioned to capitalize on this growth trend, potentially driving substantial appreciation in Ola Electric shares over the long term.

Path to Profitability

While Ola Electric currently operates at a loss, its improving gross margins and strategic initiatives suggest a path toward profitability. The timeline to break-even is a critical consideration for investors with different time horizons looking at Ola Electric shares as an investment option.

Valuation Considerations

At current price levels, Ola Electric shares trade at approximately 3.39 times book value. When compared to other pure-play EV manufacturers globally, this valuation could be considered reasonable, especially considering the growth potential. However, the continued losses and execution risks warrant careful consideration before investing in Ola Electric shares.

Investor Strategies for Ola Electric Shares

Different investment approaches may be appropriate for Ola Electric shares depending on individual goals, risk tolerance, and investment horizons.

Value Investing Perspective

Traditional value investors might find Ola Electric shares challenging at current valuations given the absence of profitability and high price-to-book ratio. However, those who see intrinsic value in the company’s market position, technology assets, and growth potential might consider gradual accumulation during periods of price weakness.

Growth Investing Approach

Growth-oriented investors may find Ola Electric’s market leadership in a rapidly expanding sector appealing. The company’s revenue growth trajectory and expanding total addressable market align with growth investment criteria, though execution risks remain significant when considering Ola Electric shares.

Dollar-Cost Averaging Strategy

Given the volatility and uncertain near-term outlook, a dollar-cost averaging approach might be suitable for investors with strong conviction in the long-term EV transition but concerns about short-term market movements. This approach allows gradual building of positions in Ola Electric shares while potentially reducing the impact of short-term price volatility.

Conclusion

Ola Electric represents a compelling yet complex investment proposition in India’s burgeoning EV landscape. Ola Electric shares offer direct exposure to the electric mobility revolution in one of the world’s largest two-wheeler markets, backed by significant manufacturing capabilities, technological innovation, and ambitious vertical integration plans.

The current valuation of Ola Electric shares reflects both near-term challenges and long-term potential. While profitability remains elusive and competitive pressures have intensified, the company’s market leadership position, strategic initiatives in cell manufacturing, and expanding product portfolio create a foundation for potential value creation.

For investors with the appropriate risk tolerance and investment horizon, the projected share price targets from 2025 to 2030 suggest significant potential returns from Ola Electric shares. However, realizing these projections depends on successful execution across multiple dimensions, including manufacturing scale-up, cost optimization, product innovation, and service excellence.

As the EV transition accelerates in India, Ola Electric’s first-mover advantages and vertical integration strategy position it uniquely in the market. Yet, these advantages must translate into sustainable competitive differentiation and eventually into profitability to justify long-term investment in Ola Electric shares.

Monitoring key performance indicators—particularly gross margin trends, market share evolution, and progress in cell manufacturing—will provide important signals about the company’s trajectory. Similarly, regulatory developments and overall EV adoption rates in India will shape the broader context in which Ola Electric operates and Ola Electric shares trade.

Ultimately, Ola Electric shares represent an investment in both a company and a transformative industry shift. For those who believe in the inevitability of electric mobility in India and Ola’s ability to lead this transition, the current share price levels may offer an attractive entry point despite near-term volatility and uncertainty in Ola Electric shares.

As with any emerging industry leader, patience and conviction will be key virtues for investors in Ola Electric shares. The road to sustainable success in the EV industry will likely include both challenges and triumphs, requiring a balanced perspective that acknowledges both the potential rewards and the inherent risks of pioneering a new mobility paradigm in India through an investment in Ola Electric shares.

Read more at worldsinsight.